Welcome to the Avalanche Weekly Overview. A one-stop-shop for the AVAX community to get up to speed on the Avalanche blockchain network’s latest updates, metrics, releases, insights, ecosystem developments and more. All in one place.

New here? Subscribe here to get updates to your inbox. Every Wednesday. 🔔

Avalanche by the numbers

AVAX price: $22.91 (-2.80%)

Max transactions per second: 342 (-25.81%)

Network’s total transactions: 7.92M (-8.01%)

Avalanche C-Chain daily txns: 137.7K (-0.36%)

DeFiLlama’s Avalanche TVL: $886.46M (-1.19%)

BENQI: $347.4M (+1.84%)

Aave: $328.92M (-1.47%)

Trader Joe: $97.01M (-6.90%)

These metrics are based on a 7-day time frame, unless noted otherwise.

Inside the network

🔺What we’re watching: ParaFi Capital, a digital asset management firm with over $1 billion in AUM, partnered with Securitize to tokenize a portion of one of its venture funds on the Avalanche network.

🔺Why it matters: As one of the largest investors in real-world asset tokenization, ParaFi’s decision to utilize Securitize and Avalanche proves the growing recognition of the blockchain as an efficient, secure, and transparent method for managing and trading financial assets.

This isn’t Securitize’s first time tokenizing assets on Avalanche either.

In 2022, KKR & Co., one of the largest investment management firms in the US, tokenized a healthcare-focused fund on Avalanche via Securitize – after a four-year-long internal process.

Tokenizing private market strategies aims to introduce a new level of liquidity and accessibility to institutional investors, unlocking a broader range of benefits such as programmability, streamlined settlement processes, and reduced legal and administrative costs.

Last year, Avalanche Foundation launched an initiative of up to $50 million, dubbed Avalanche Vista, to focus on asset tokenization on its blockchain across different sectors like equity, credit, real estate and commodities.

"Financial markets demand innovation, and recently, we've seen significant leaps forward in the evolution of financial assets leveraging blockchain and tokenization as enablers for greater access and utility,” John Wu, president of Ava Labs, said in a blog post.

In general, the usage of blockchain technology could speed up settlement processes and offer long-term advantages such as liquidity or reduce administrative costs.

If institutional firms continue to choose to utilize Avalanche’s infrastructure to come onchain, the network can become the go-to landing place for institutional investors looking to tokenize their venture funds and assets.

🔺The bigger picture: Across blockchains, traditional firms like BlackRock, Franklin Templeton, Misyon Bank and others are slowly beginning to integrate blockchain technology into their products and services.

ParaFi’s latest endeavor highlights the growing role blockchain technology has in facilitating the transition of traditional assets onto the blockchain.

Similar to how developers decide what blockchain they decide to use for their protocol or development of an app based on usage rate, institutional firms may take into account who uses what in terms of blockchain technology offerings. As a result, the addition of ParaFi Capital’s fund into the Avalanche ecosystem can attract more institutional adoption and tokenization onchain.

Scaling the ecosystem

Defi Kingdoms: 3.03M (-20.70%)

Shrapnel: 146.5K (-13.18%)

Tiltyard: 40.6K (-38.21%)

Pulsar announced its web3 gaming-centric L1 will launch its mainnet on Oct. 18

GoGoPool partnered with Superform to provide staking mechanics to the Avalanche network

Avalanche hit 27.1M unique addresses on the network (chart below)

Active L1s: 39

L1 validators: 269

Total L1 validators: 1,480

Total blockchains created in the Avalanche network: 104

Total staked across Subnets: 541,247 AVAXx`

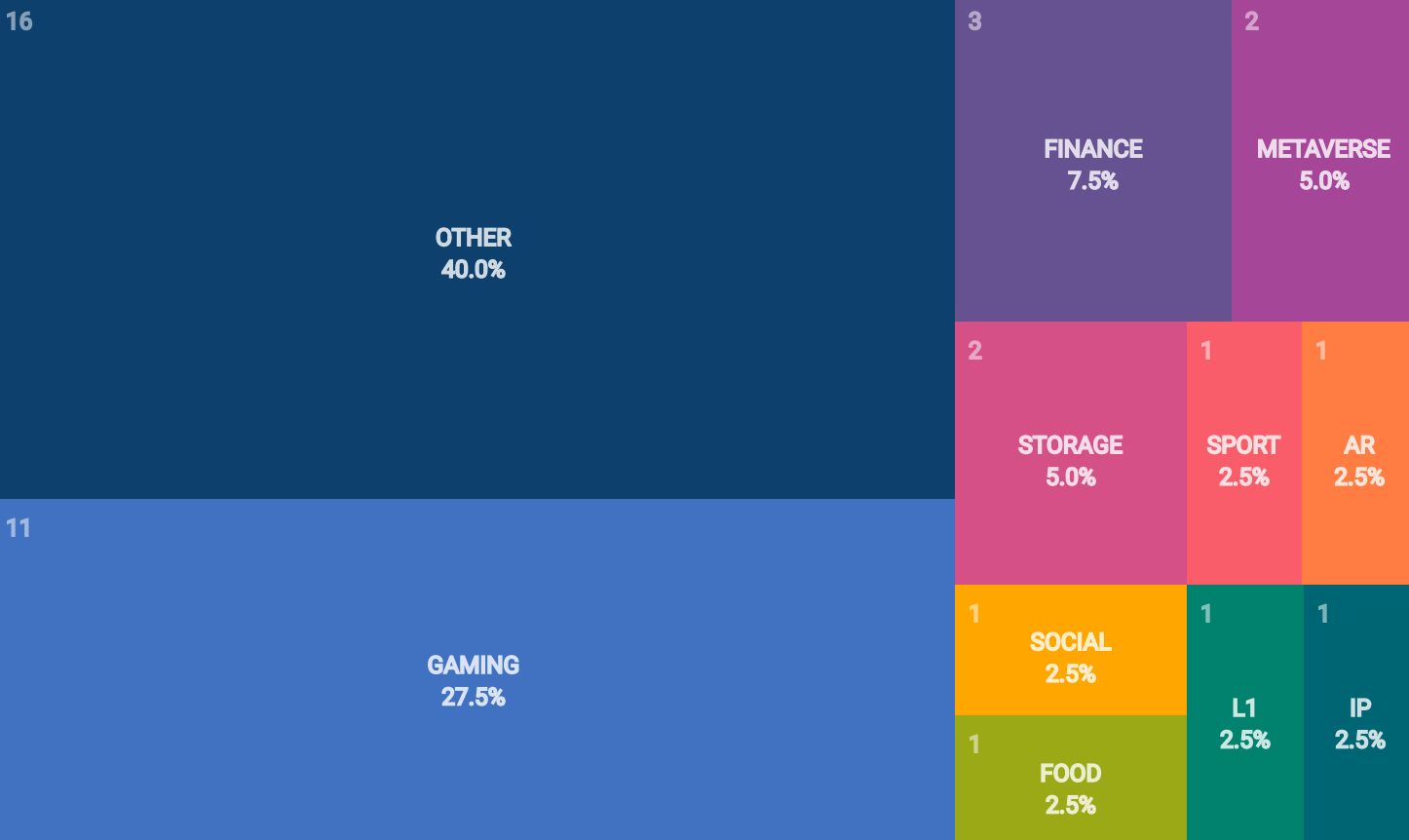

Distribution of L1s by category. Source: Snowpeer

AVAX community wins

Learn more about the gaming-focused Eclipse L1 in a thread written by X user that_techieboy

Listen to this X space hosted by Mozemhe that dove into Avalanche and its web3 gaming ecosystem

X user KyleWillson created a video that showcased PLYR and its gaming-centric L1

Avalanche Archives

Here’s Avalanche-based articles that made headlines this week.

ParaFi Capital tokenizes portion of $1 billion venture funding on Avalanche via Securitize (The Block)

State of Avalanche Q2 2024 (Report by Messari)

Avalanche9000: A Leap Forward (CryptoMancer on Substack)

Check out the Avalanche blog for more updates.

Join in the fun

Want to dive deeper into Avalanche?

Meet up with the community at Avalanche Summit III, an event in Buenos Aires, Argentina from Oct. 16-18

Compete in the Avalanche Summit LATAM Hackathon for a chance to win a share of a $50K prize pool

Join the Avalanche Discord and take part in its weekly developer workshops, every Wednesday

To get this newsletter delivered to your inbox every Wednesday, subscribe here.

This product was built by Token Relations.

This information is for entertainment purposes only. It should not be considered financial advice, nor should it be used to make investment decisions. Cryptocurrencies are high risk and you should consult a financial professional before making any financial decisions. Make sure you do your own research.